Appraisal less than offer on house

Kate Mondo

3 years ago

Featured Answer

Sort by:Oldest

Comments (19)

maifleur03

3 years agoRelated Professionals

Abington General Contractors · Cedar Hill General Contractors · Clarksville General Contractors · Conneaut General Contractors · Great Falls General Contractors · Hammond General Contractors · Hercules General Contractors · Mount Prospect General Contractors · Mount Vernon General Contractors · Poquoson General Contractors · Rosemead General Contractors · Summit General Contractors · Vincennes General Contractors · West Mifflin General Contractors · Round Lake Home Stagersfunctionthenlook

3 years agolast modified: 3 years agoUser

3 years agoDenita

3 years agolast modified: 3 years agohomechef59

3 years agoKate Mondo

3 years agomaifleur03

3 years agoDenita

3 years agohomechef59

3 years agoStax

3 years agocpartist

3 years agolast modified: 3 years agoshead

3 years agoLittle Bug

3 years agoncrealestateguy

3 years agograywings123

3 years agoaziline

3 years agoDenita

3 years agolast modified: 3 years agoDenita

3 years ago

Related Stories

FEEL-GOOD HOME9 Ways to Boost Your Home’s Appeal for Less Than $75

Whether you’re selling your home or just looking to freshen it up, check out these inexpensive ways to transform it

Full Story

BEFORE AND AFTERSA ‘Brady Bunch’ Kitchen Overhaul for Less Than $25,000

Homeowners say goodbye to avocado-colored appliances and orange-brown cabinets and hello to a bright new way of cooking

Full Story

GARDENING AND LANDSCAPINGDig This Garden Shed Makeover for Less Than $300

New paint, accessories and raised vegetable beds turn a drab outpost into a colorful charmer

Full Story

BATHROOM DESIGNBathroom of the Week: Big Style in Less Than 43 Square Feet

A Toronto designer gives a compact hall bath an elegant and luxe look on a budget

Full Story

LIFEThe Polite House: On Dogs at House Parties and Working With Relatives

Emily Post’s great-great-granddaughter gives advice on having dogs at parties and handling a family member’s offer to help with projects

Full Story

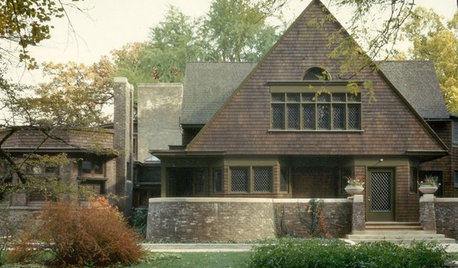

FRANK LLOYD WRIGHTWhat Frank Lloyd Wright's Own House Tells Us

The buildings dreamed up here changed the course of architecture — and Wright's home was no less a design lab than the studio itself

Full Story

COLORPick-a-Paint Help: How to Create a Whole-House Color Palette

Don't be daunted. With these strategies, building a cohesive palette for your entire home is less difficult than it seems

Full Story

HOUZZ TOURSMy Houzz: A Seattle Remodel Offers Accessibility

Access for legs and wheels was the priority in this Washington state home's renovation, but universal design doesn't mean less style

Full Story

REMODELING GUIDESThe Dos and Don'ts of Home Appraisal

Selling your house? These tips from the pros will help you get the best possible appraisal

Full Story

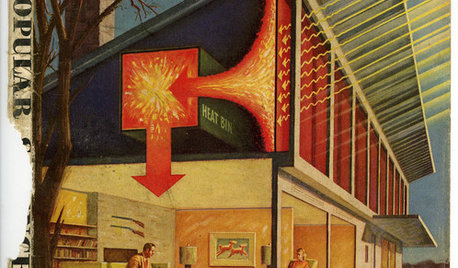

GREEN BUILDINGChampioning the Solar House, From the 1930s to Today

Homes throughout history that have used the sun offer ideas for net-zero and passive homes of the present, in a new book by Anthony Denzer

Full StorySponsored

More Discussions

Sammy