Search results for "Financial loan" in Home Design Ideas

Photo: Sarah Greenman © 2013 Houzz

Traditional one-story brick exterior home idea in Dallas

Traditional one-story brick exterior home idea in Dallas

Example of a huge eclectic red three-story mixed siding exterior home design in Burlington with a metal roof

Find the right local pro for your project

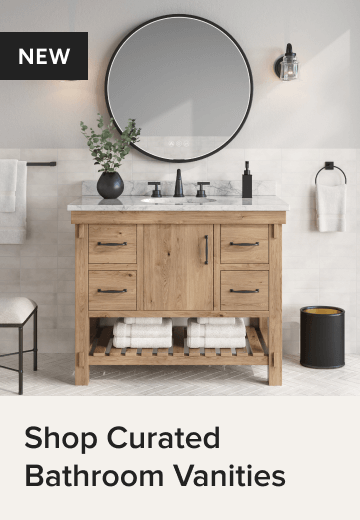

This big project remodeling begin because of a leak true the window of the bathroom and another leak from the bedroom window. We took care of this small project , after couple days of working together she was very interesting in full remodel for her house. Eventually our team help her with planning the project and getting the right financial loan and comfortable monthly payment and use + increase the value of the property. we are so happy to work on this house and make incredible change for great living experience for many years later.

This big project remodeling begin because of a leak true the window of the bathroom and another leak from the bedroom window. We took care of this small project , after couple days of working together she was very interesting in full remodel for her house. Eventually our team help her with planning the project and getting the right financial loan and comfortable monthly payment and use + increase the value of the property. we are so happy to work on this house and make incredible change for great living experience for many years later.

Home loan, as the name suggests, is a financing solution that allows you to borrow funds to purchase a property. Home loans are secured loans taken from a financial institution for the purpose of buying a residential property. Fastgrow Finance offers top-notch home loan and financial mortgage solutions through out Australia. To read more about Home loans, Visit Fastgrow Finance here - https://www.fgfin.com.au/services/home-loans

Happy Investments, Inc. has been a Mortgage Broker and loan company serving California since 2005. Happy Investments, Inc. focusing on both Residence and Commercial Mortgage loans. Our specialty is providing financing to people with complicated financial Situations. Our Company has many Mortgage programs feature competitive interest rates, low down payment requirements, flexible underwriting guidelines, Each of these features are designed to make your Mortgage Loan more affordable. We Provide Hard Money Loans, Private Money Loans, Home Equity Loans, Commercial Loans. Vacant Land Loans, Rehab Loans, FHA Loans, Mobile Home Loans, Home Purchase Loans, Home Refinance Loans, Commercial Loans, Bank Statement Home Loans, First Time Home Buyers, Home Improvement Loans, Transnational Funding and Many More

Happy Investments, Inc. Ontario CA and nearby cities, Provide Mortgage Broker, Hard Money Loans, Private Money Loans, Home Equity Loans, Commercial Loans. Vacant Land Loans, Rehab Loans, FHA Loans, Mobile Home Loans, Home Purchase Loans, Home Refinance Loans, Commercial Loans, Bank Statement Home Loans, First Time Home Buyers, Home Improvement Loans, Transnational Funding and Many More

Contact Us:

Happy Investments, Inc. Ontario CA

3045 S ARCHIBALD AVE H 299-J,

ONTARIO, CA 91761

Phone: 909-545-6269

Email: hiiloansontario@gmail.com

Website: http://www.happyinvestmentsinc.com/mortgage-broker-ontario-ca/

A R C H I T E C T U R E T H R O U G H C O M M U N I T Y D R I V E N E N A G A G E M EN T

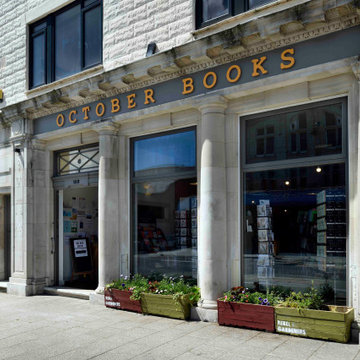

October books was formed in 1977 in Portswood High street, Southampton. It is a non fro profit co-operative radical neighborhood independent book shop. The shop itself is independent from any political organization, and looks to promote a fair and equal society.

The book shop was featured in an article in the Guardian in June 2014, with Own Hatherley discussing “How the spirit of revolution lives on in radical bookshops “ and how it only survived that year, due to local financial contribution’s.

In January 2018 the collective decided it was time to free itself from the large rental being paid to its land lord at the time and planned for a brighter future. The co-operative then entered into a collaborative consortium with a local homeless charity ‘The Society of St James’ with a view to purchasing their own building, a former Natwest Bank. To do this they had to raise £300,000 of community funds, selling loan stock and crowd funding. By April 2018 this had been surpassed, with incredible community passion and engagement. The bank was purchased in April 2018 and Studio B.a.d where appointed to undertake a feasibility study and planning application to re imagine not only the book shop of the future, but the future of the high street!

The existing bank fronts the high street in Porstwood Southampton and the key proposal was to convert the ground floor to the new book shop and community space. The first and second floors are residential units for the homeless charity ‘The Society of St James’ .

The design strategy has been to create a very simple forensic and sympathetic review of the existing former bank building. The street elevation at ground level has some key Neo Classical features that give opportunities for this to be cleaned to give a simple face to the high street. We also reused the existing concrete and steel bank vault, which now acts as the book shop stock collection and the existing cash machine steel vault is now encapsulated within the shop counter.

One of the key moves for the rear of the ground floor, has been to look at creating a street, that stitches together the various activities that will take place. Our proposal was to develop a community street, that threads through the center of the ground floor.

The concept has been conceived around social interaction, so that everyone within the community, regardless of the activities: reading, writing, talking, working, creating, interacting, resting, can feel part of the community spirit within the welcoming space’s of the street.

The book shop opened in Nov 2018, with a human chain organized to moves thousands of books from the old to new shop along the high street on a Sunday morning with 200 people, the story went viral in national and international media, featuring in both the Guardian and New York Times.

WEB LINKS

https://www.theguardian.com/uk-news/2018/oct/29/southampton-bookshop-october-books-enlists-human-chain-to-move-to-new-store

https://www.bbc.co.uk/news/uk-england-hampshire-46020559

https://www.washingtonpost.com/lifestyle/2018/10/30/tiny-bookstore-had-relocate-hundreds-formed-human-chain-move-its-books/?utm_term=.f6df0171de8f

https://www.huffingtonpost.co.uk/entry/human-chain-southampton-october-books_n_5bd83fcce4b0dee6eecdd3fb

A R C H I T E C T U R E T H R O U G H C O M M U N I T Y D R I V E N E N A G A G E M EN T

October books was formed in 1977 in Portswood High street, Southampton. It is a non fro profit co-operative radical neighborhood independent book shop. The shop itself is independent from any political organization, and looks to promote a fair and equal society.

The book shop was featured in an article in the Guardian in June 2014, with Own Hatherley discussing “How the spirit of revolution lives on in radical bookshops “ and how it only survived that year, due to local financial contribution’s.

In January 2018 the collective decided it was time to free itself from the large rental being paid to its land lord at the time and planned for a brighter future. The co-operative then entered into a collaborative consortium with a local homeless charity ‘The Society of St James’ with a view to purchasing their own building, a former Natwest Bank. To do this they had to raise £300,000 of community funds, selling loan stock and crowd funding. By April 2018 this had been surpassed, with incredible community passion and engagement. The bank was purchased in April 2018 and Studio B.a.d where appointed to undertake a feasibility study and planning application to re imagine not only the book shop of the future, but the future of the high street!

The existing bank fronts the high street in Porstwood Southampton and the key proposal was to convert the ground floor to the new book shop and community space. The first and second floors are residential units for the homeless charity ‘The Society of St James’ .

The design strategy has been to create a very simple forensic and sympathetic review of the existing former bank building. The street elevation at ground level has some key Neo Classical features that give opportunities for this to be cleaned to give a simple face to the high street. We also reused the existing concrete and steel bank vault, which now acts as the book shop stock collection and the existing cash machine steel vault is now encapsulated within the shop counter.

One of the key moves for the rear of the ground floor, has been to look at creating a street, that stitches together the various activities that will take place. Our proposal was to develop a community street, that threads through the center of the ground floor.

The concept has been conceived around social interaction, so that everyone within the community, regardless of the activities: reading, writing, talking, working, creating, interacting, resting, can feel part of the community spirit within the welcoming space’s of the street.

The book shop opened in Nov 2018, with a human chain organized to moves thousands of books from the old to new shop along the high street on a Sunday morning with 200 people, the story went viral in national and international media, featuring in both the Guardian and New York Times.

WEB LINKS

https://www.theguardian.com/uk-news/2018/oct/29/southampton-bookshop-october-books-enlists-human-chain-to-move-to-new-store

https://www.bbc.co.uk/news/uk-england-hampshire-46020559

https://www.washingtonpost.com/lifestyle/2018/10/30/tiny-bookstore-had-relocate-hundreds-formed-human-chain-move-its-books/?utm_term=.f6df0171de8f

https://www.huffingtonpost.co.uk/entry/human-chain-southampton-october-books_n_5bd83fcce4b0dee6eecdd3fb

Showing Results for "Financial Loan"

This big project remodeling begin because of a leak true the window of the bathroom and another leak from the bedroom window. We took care of this small project , after couple days of working together she was very interesting in full remodel for her house. Eventually our team help her with planning the project and getting the right financial loan and comfortable monthly payment and use + increase the value of the property. we are so happy to work on this house and make incredible change for great living experience for many years later.

It’s always an excellent idea to renovate some corners in your house if you are looking to sell. It is crucial for you to remember to ‘sell it right,’ which means doing the upgrades and renovations accurately for your homebuyer. Some of the best home renovations — for instance, an upgraded kitchen, remodeled bathroom, or a new deck — can get expensive. This is why it is important to know what kind of return you might expect before you think of taking on a remodeling project.

Top Home Renovations in 2021

If you have smartly budgeted for major remodeling projects, here are some of the upgrades that will immediately add more value to your homes:

Kitchen Remodel

People can go wild in kitchen renovations, but it’s not always required. A kitchen remodeling, if done the right way, is certain to add more value to your home. You will love an even higher return if you remodel a kitchen with traditional designs and builds. This will include replacing your cabinets, refrigerator, stove, flooring, and even sinks and faucets.

Nowadays, a kitchen’s functionality and convenience are becoming more and more important. For instance, lowered light switches, cabinets, and racks can make it simpler for an elderly person or someone with a disability to explore the kitchen if they use a wheelchair. Cabinets with a hydraulic system can make it possible for a homeowner to move their position, ensuring it’s available within your reach no matter your mobility level.

Improving Your Outdoor Appeal

The outdoor appeal is basically the first impression of your home. That old front door, cracked driveway won’t help potential buyers feel an eternal connection with your home. The outdoor appeal can be improved with the application of new paint, gardening, or attractive landscaping. Hence, it is necessary for you to consider beforehand what improvements you are going to make, what you can do yourself, and what you need to outsource.

Begin where your property meets the main street. Are the walls well maintained and colored? Do driveways need to be redone or just a quick water blast to clean them? Do you need to paint your door or close the cracks on them or add a couple of planter pots to give more warmth to the entrance?

More expensive things include painting your house, adding a deck, or fencing your property. Before taking these costly projects, do seek professional advice about whether this will increase your property’s value.

Including Square Footage to Your Home

As mentioned above, expensive additions in remodeling include house extensions and reconfigurations of old rooms. This may lead to a larger ROI, so they’re worth assessing. You may want to add a bedroom, build a home office corner, make the living area by making it more spacious or add another bathroom. These extensions all add value to your home, but you’ll want to guarantee that you can get your money back once you sell the property.

Big projects are more expensive. Homeowners may want to think of applying for a home improvement loan to help them finance the project or ensure they have financial assistance in case the cost goes over the board.

The Bottom Line

Renovating your home not only adds to your excitement but can also increase your home’s value over time, as well.

If you live in an urban area, your listing might be competing with other upgraded homes to grab the buyers’ attention. When you refinance your house, for example, remodeling will be considered when a property appraiser studies your home’s current market value. Higher home value means you’ll get more equity and a lower loan-to-value ratio. Moreover, you might even be able to cancel personal mortgage insurance payments earlier than expected.

When you decide to sell your home, buyers will expect to see a clean, attractive home with modern updates that’s ready to move in.

This big project remodeling begin because of a leak true the window of the bathroom and another leak from the bedroom window. We took care of this small project , after couple days of working together she was very interesting in full remodel for her house. Eventually our team help her with planning the project and getting the right financial loan and comfortable monthly payment and use + increase the value of the property. we are so happy to work on this house and make incredible change for great living experience for many years later.

1