Pay with cash or finance a pool?

kgolby

15 years ago

Featured Answer

Sort by:Oldest

Comments (24)

smbnobles

15 years agoalaskadiver

15 years agoRelated Professionals

Norfolk Landscape Architects & Landscape Designers · Rancho Cordova Landscape Architects & Landscape Designers · Bloomington Landscape Contractors · Darien Landscape Contractors · Edinburg Landscape Contractors · Garland Landscape Contractors · North Potomac Landscape Contractors · Norwalk Landscape Contractors · Reedley Landscape Contractors · Ronkonkoma Landscape Contractors · Soddy Daisy Landscape Contractors · Cape Coral Decks, Patios & Outdoor Enclosures · Rantoul Decks, Patios & Outdoor Enclosures · West Bend Decks, Patios & Outdoor Enclosures · Scotts Valley Decks, Patios & Outdoor Enclosureskgolby

15 years agostonesmama

15 years agosandradee

15 years agokgolby

15 years agodonnawb

15 years agosubl1002

15 years agosmbnobles

15 years agostonesmama

15 years agotresw

15 years agoputerputz

15 years agoPixie1

15 years agokgolby

15 years agollcp93

15 years agobusyredhed

15 years agogracedunderpressure

15 years agokgolby

15 years agotresw

15 years agoBoby Huffard

15 years agollcp93

15 years agogracedunderpressure

15 years agolindamarie

15 years ago

Related Stories

MOVINGHow to Avoid Paying Too Much for a House

Use the power of comps to gauge a home’s affordability and submit the right bid

Full Story

REMODELING GUIDES5 Ways to Protect Yourself When Buying a Fixer-Upper

Hidden hazards can derail your dream of scoring a great deal. Before you plunk down any cash, sit down with this

Full Story

DISASTER PREP & RECOVERY10 Contractor Scam Warning Signs

Protect yourself, your home and your finances after a natural disaster by following these tips for sniffing out storm chasers

Full Story

MOVINGTips for Winning a Bidding War in a Hot Home Market

Cash isn’t always king in a bidding war. Get the home you want without blowing your budget, using these Realtor-tested strategies

Full Story

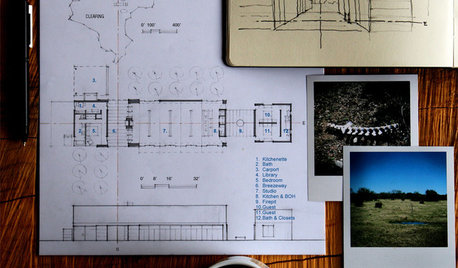

DESIGN PRACTICEDesign Practice: Start-up Costs for Architects and Designers

How much cash does it take to open a design company? When you use free tools and services, it’s less than you might think

Full Story

INSIDE HOUZZHouzz Survey: See the Latest Benchmarks on Remodeling Costs and More

The annual Houzz & Home survey reveals what you can expect to pay for a renovation project and how long it may take

Full Story

ARCHITECTUREDesign Practice: The Basics of Marketing Your Business

Pro to pro: Attract clients and get paying work by drawing attention to your brand in the right places

Full Story

LIFEMake Money From Your Home While You're Away

New services are making occasionally renting your home easier than ever. Here's what you need to know

Full Story

BUDGETING YOUR PROJECTDesign Workshop: Is a Phased Construction Project Right for You?

Breaking up your remodel or custom home project has benefits and disadvantages. See if it’s right for you

Full Story

GREEN BUILDINGGoing Solar at Home: Solar Panel Basics

Save money on electricity and reduce your carbon footprint by installing photovoltaic panels. This guide will help you get started

Full StoryMore Discussions

teppy