Please explain property taxes after buying...

cissado

16 years ago

Related Stories

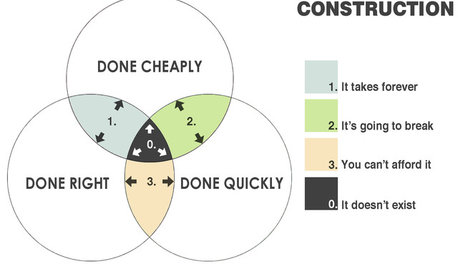

COFFEE WITH AN ARCHITECTThe Elements of Design Explained With Venn Diagrams

Design doesn't have to be hard to understand. It just needs the right presentation

Full Story

MOVING5 Risks in Buying a Short-Sale Home — and How to Handle Them

Don’t let the lure of a great deal blind you to the hidden costs and issues in snagging a short-sale property

Full Story

HOME OFFICESQuiet, Please! How to Cut Noise Pollution at Home

Leaf blowers, trucks or noisy neighbors driving you berserk? These sound-reduction strategies can help you hush things up

Full Story

BATHROOM DESIGNUpload of the Day: A Mini Fridge in the Master Bathroom? Yes, Please!

Talk about convenience. Better yet, get it yourself after being inspired by this Texas bath

Full Story

BEFORE AND AFTERSMore Room, Please: 5 Spectacularly Converted Garages

Design — and the desire for more space — turns humble garages into gracious living rooms

Full Story

MY HOUZZMy Houzz: After Renovating, a Family Flips Over Its House

What started as a 'buy, renovate and flip' project turns into so much more for a creative family in Australia

Full Story

LIVING ROOMSCurtains, Please: See Our Contest Winner's Finished Dream Living Room

Check out the gorgeously designed and furnished new space now that the paint is dry and all the pieces are in place

Full Story

MOST POPULARWhat to Do After a Hurricane or Flood

How you treat your home after a natural disaster can make all the difference in its future livability — and your own personal safety

Full Story

DISASTER PREP & RECOVERYHouzz Tour: Family Rebuilds Home and Community After Hurricane Sandy

This restored coastal New Jersey house — now raised 9 feet off the ground — offers inspiration for neighbors considering a return

Full Story

MOST POPULAR9 Real Ways You Can Help After a House Fire

Suggestions from someone who lost her home to fire — and experienced the staggering generosity of community

Full StoryMore Discussions

xamsx

cissadoOriginal Author

Related Professionals

Alhambra General Contractors · American Canyon General Contractors · Binghamton General Contractors · Fort Pierce General Contractors · Glenn Dale General Contractors · Jackson General Contractors · Lakeside General Contractors · Modesto General Contractors · National City General Contractors · San Carlos Park General Contractors · Shorewood General Contractors · West Whittier-Los Nietos General Contractors · Winfield General Contractors · Spring Valley Home Stagers · Middle Island Interior Designers & Decoratorstom418

richard_f

redcurls

triciae

Linda

theroselvr

chisue

kitchenshock

carmen_grower_2007

chisue

cissadoOriginal Author

theroselvr

cissadoOriginal Author